In the USA, where most patients have insurance to deal with their medical conditions, many patients wonder what is coordination of benefits. It comes into play when a patient registers with more than one payer. Whether it is through multiple employers, a spouse’s plan, or a combination of Medicare and private insurance, these overlapping coverages confuse the majority of patients and providers.

That’s where coordination of benefits comes in to ensure insurance companies work together to process claims without overpaying. But what is COB in healthcare? This detailed guide covers its important, purpose, how it processes, and ways to prevent COB denial in medical billing.

Coordination of benefits is also known as cob insurance coverage process, where insurance companies determine which plan is responsible for the medical claim when a patient is registered with more than one payer at once. The goal of COB is to prevent the payer from paying duplicate payments or overpaying the patient by checking the cob health insurance status and also determining who is the primary and who is the secondary payer to prevent denials.

Coordination of benefits medicare or healthcare, is a process used to decide which insurance plan will pay first and which will pay second for patient treatment, if they have more than one insurance. Now, from first and second, we mean the primary and secondary payers as described below.

This entire healthcare COB process is managed by COB rules, which prioritize the payers (Primary, secondary, tertiary) on the basis of coverage type, policyholder status, and legal mandates.

The primary purpose of coordination of benefits COB is to ensure that the total amount paid by all plans does not exceed the actual cost of the healthcare services. There are other purposes it serves for patients, providers, and payers alike.

According to census.gov, about 43 Million People in the U.S. had multiple health plans. They may find themselves covered under a dual plan due to employment status, family circumstances, or specific eligibility for gov programs. Here are some scenarios depicting when people have two or more cob health insurance plans.

| Situation | Explain |

| Marriage with both partners insured | Both spouses have active employer-sponsored plans, and they list each other as dependents. |

| Children’s coverage under both parents | Each parent’s health plan lists the child and mentions them as a dependent. |

| Medicare, along with employee insurance | The person is enrolled in Medicare but continues with access to employer insurance. |

| The individual with COBRA and new employer coverage | Coverage continues from a former job COBRA, while enrolling in a new employer plan. |

| Students with school and parental insurance | Students have institutional coverage while still eligible for parents’ insurance under 26. |

Having dual plan coverage may benefit patients by reducing healthcare expenses, but it could be complex for billing. Hiring an expert patient billing service is a solution to manage COB workflows.

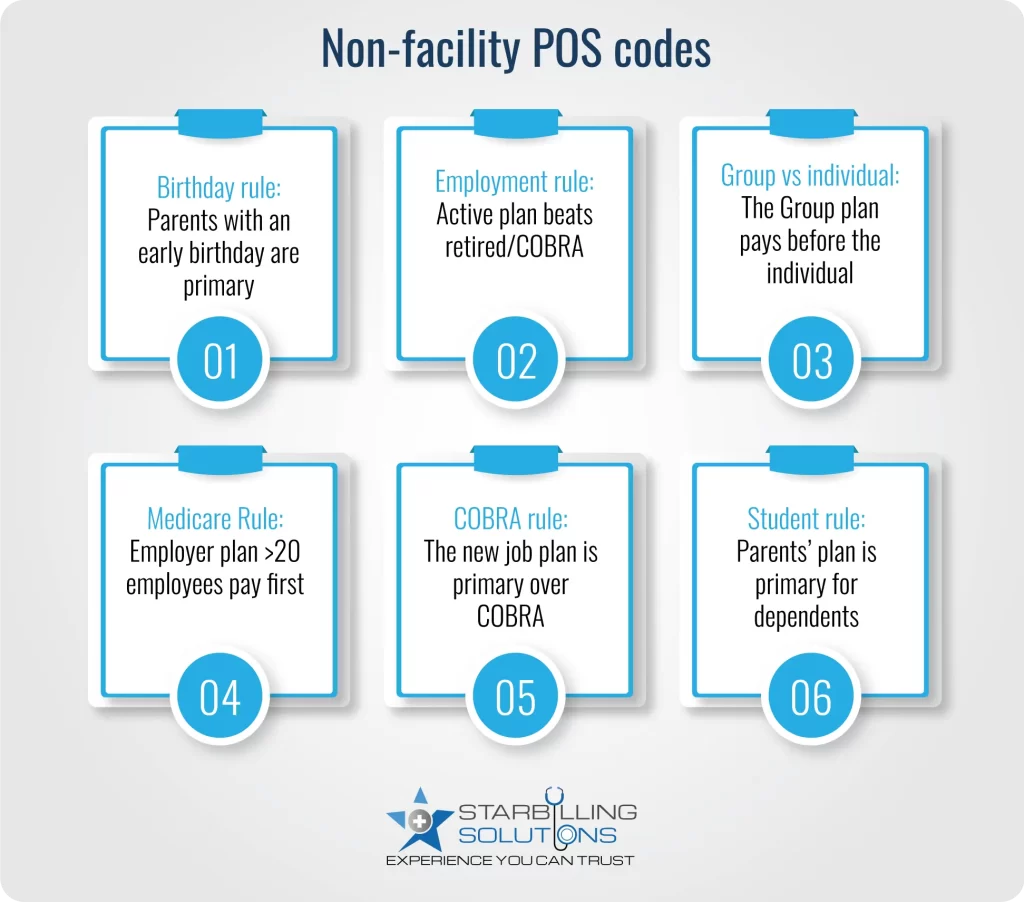

COB rules by payers are put in place to allow patients and providers to understand what insurance will pay first under different circumstances. Below, we provide the rules along with coordination of benefits examples for each one.

The birthday rule for cob in medical billing says the parent whose birthday comes first will provide the primary coverage for the child’s condition. However, remember that if parents are divorced or separated, then a custody agreement or a court order could override the birthday rule.

| Parent | Birthday | Coverage Role |

| Mom | May 15 | Primary |

| Dad | November 25 | Secondary |

Example: A child is covered by both mom and dad. Mom’s birthday is May 15, and Dad’s is November 25. Mom’s plan is primary.

If one plan is from current employment, and the other is from retirement or COBRA, the active employment plan is the primary cob health insurance. Medicare is usually secondary to employer-sponsored insurance, only if the employer has more than 20 employees.

| Plan Type | Employment Status | Coverage Role |

| Employer plan | Active | Primary |

| Medicare (retired) | Retired | Secondary |

Example: A retiree has active Medicare, but he is working part-time in an organization with more than 20 employees offering insurance. The employer plan is primary because it’s active.

A group insurance plan from an employer or organization is primarily over an individual plan (purchased from a private insurer). This keeps individual plans away from being charged first for employer-related benefits of care coordination.

| Plan type | Source | Coverage Role |

| Group Plan | Employer | Primary |

| Individual Plan | Private insurer | Secondary |

Example: Alex is covered by his company’s group plan and also purchased an individual policy for additional coverage. The group plan pays first.

Medicare + employer insurance: For organizations with more than 20 employees, the employer plan is primary, while for employers with fewer than 20 employees, Medicare is primary.

| Employer size | Primary plan | Secondary plan |

| > 20 employees | Employer plan | Medicare |

Medicare + Medicaid: In this coordination of benefits medicare condition, Medicare is always primary, and Medicaid is the payer of last resort and only pays after all other plans.

| Coverage type | Primary plan | Secondary plan |

| Dual-eligible | Medicare | Medicaid |

Suppose you have COBRA insurance still active from your past job, and you are currently working in another organization. In that case, the current employment plan will be primary while COBRA will remain secondary as per the coordination of benefits rules.

| Coverage Type | Source | Coverage Role |

| Employer plan | New job | Primary |

| COBRA | Previous job | Secondary |

Examples: An employee, Sarah, is still under COBRA coverage from her last job but now works for another company that offers her insurance plan. Her new job’s cob for insurance plan will pay first.

If a student is covered under their school and parents’ plan, the parental plan would be primary (if the student is dependent). However, there is an exception in the insurance coordination of benefits rule, saying a school plan could be used as primary coverage in the absence of formal parental coverage.

| Coverage type | Status | Coverage Role |

| Parental plan | Dependant students | Primary |

| School plan | Student health plan | Secondary |

Example: A college student is under his dad’s plan while also having a college health insurance plan. Since he is dependent, Dad’s plan is primary.

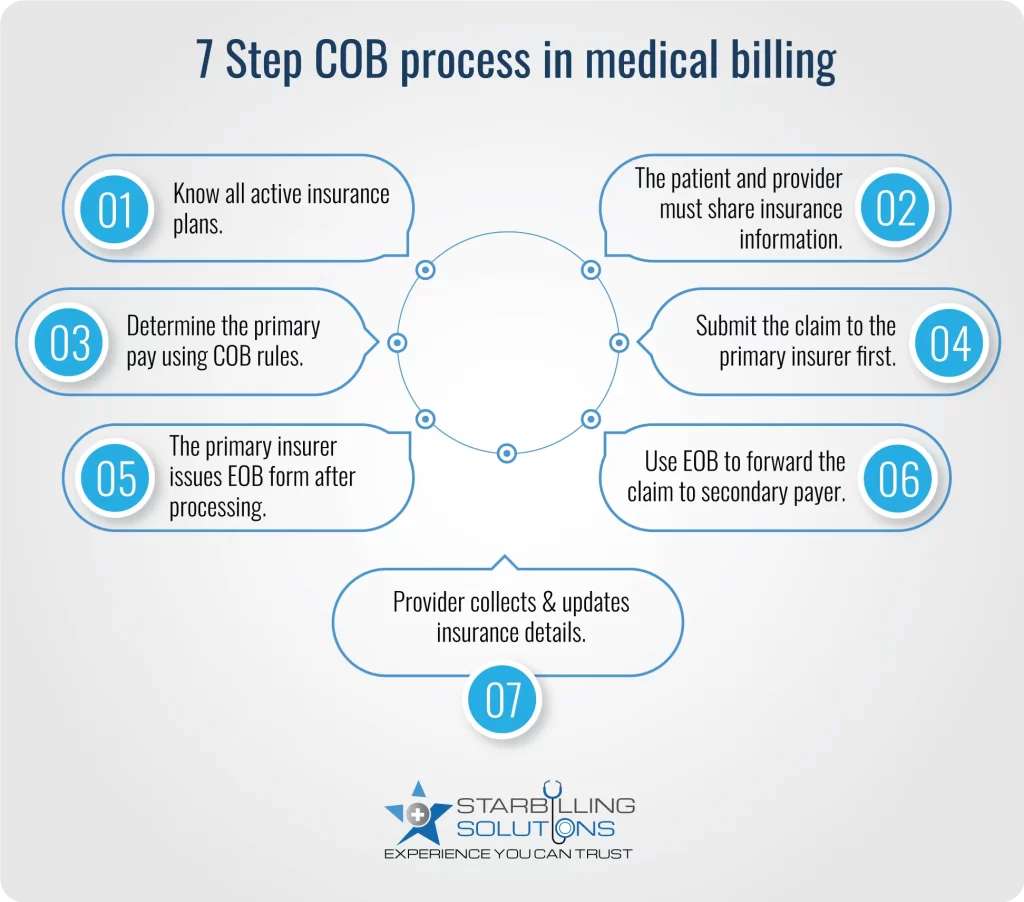

The Cob insurance working process is discussed below, determining payment responsibilities between insurers. Without it, two insurance companies may pay for the same medical bill, leading to insurance fraud and overpayment.

The COB process starts by understanding all the insurance plans under which a patient is actively registered. The patient and providers are responsible for providing cob with insurance information during claim registration.

Once the patient’s multiple insurance is confirmed, the next step is to determine which insurance company would pay first. To do this, follow the cob healthcare rules, such as the employment status birthday rule, MSP Rule, etc. These rules are required to avoid COB denial and delays.

The health provider now submits the claim to the primary insurance company first. The insurer processes the claims according to coverage rules, deductibles, copayments, and allowed cob amount. After that, the primary insurer issues an EOB form to the provider, listing what is paid and what remains for the patient and secondary payer.

Now, when the provider has an EOB in hand, they submit the benefits of care coordination claim to the secondary insurer. This claim lists what the primary payer has paid and what is left. After reviewing it, the secondary payer may pay some or all of the remaining payment, depending on the payment plan.

During the entire COB process, the healthcare provider gathers all the necessary insurance information from the patient and keeps it updated to avoid denials and boost healthcare reimbursement. On the other hand, the patient may be asked to pay any cost out of pocket (if left after insurance coverage) or to fill out the coordination of benefits cob form declaring all active insurance plans.

Some common COB issues with insurance lead to challenges like claim denials, delayed payments, miscommunication among payers, etc. Here’s a detailed outlook.

Avoiding COB related denials are important for improving cash flow from the payer to the provider. For further detail, below we provider tips to avoid cob denials and delays.

Dealing with coordination of benefits (cob) requires experience and a clear understanding of COB rules. That’s when to outsource medical billing agency to ensure accurate cob healthcare handling, reduce claim denials, and improve reimbursement.With our expert biller and coder, practices can achieve clarity, compliance, and control over complex insurance processes. So partner with us today and streamline cob medicare and protect your revenue integrity.

The cob insurance meaning “coordination of benefits”, a process that improves the medical billing services by avoiding duplication of coverage and overpayment.

In medical billing, COB for insurance is a process used by insurance companies in cases when a patient has multiple insurance plans. The purpose of COB is to determine that patients don't receive more than 100% of their healthcare expenses from their insurance plans.

The EOB, on the other hand, stands for Explanation of Benefit, which is a document that is provided by the insurance company and explains how a claim has been processed, including amounts paid and any patient responsibility.

Medicaid is always the payer of last resort, which means Medicaid can’t be the primary payer as per the coordination of benefits rules.

If you failed to report that you have more than one cob with insurance plan, the primary payer would deny the claim, or it may even lead to legal action against you. As a result, you may have to pay all the costs out of your pocket.

Update your coordination of benefits (cob) information at least once a year or whenever there is a change in coverage, such as a new job, divorce, a child turning 26, etc.