Minimize claim rejection with our expert denial management services, and get quick payment recovery.

Facing payment delay due to excessive claim denials? Hire Star Billing Solution's efficient denials management services to boost your claim approval rate. With expertise in identifying denial root causes, imposing corrections, and resubmitting, you’ll get paid timely. Additionally, we don't just fix insurance claim denial but also follow payer regulations to assist practices in preventing future denials and improving RCM. So, let experts handle your denial claims.

With over a decade of experience in denials management services, we offer proven denial management solutions and outcomes for practitioners. This includes overcoming all the loopholes causing excessive insurance claim denial. The professional and certified team would work to improve claim approval, maximize revenue recoveries, enhance patient satisfaction, and ultimately increase cash flow.

Make a strong bond with your patients by focusing more on their health while we handle your claim denial process. With timely and accurate claims denial management services, we also assist in reducing patients' financial burdens related to unexpected bills. All together, this results in a positive patient experience, which leads to higher patient loyalty and referrals.

Our trusted denial management services identify historical claim data to analyze denial trends, root causes, and patterns. This enables our proficient team to prepare accurate appeals and handle claim scrubbing and submission with a higher claim approval rate.

Our Star Billing Solution's revenue cycle denial management team will assess your denials caused by missing and duplicate claims, wrong codes, missing deadlines, etc. The core aim here is to make sure valid claims are resubmitted to increase revenue recovery by maximizing claim approval.

We leverage RPA-induced systems to identify claim root and propose error-free appeals with supporting documents. These automated systems guarantee quick claim approval, which leads to better financial performance and improved cash flow for healthcare practices.

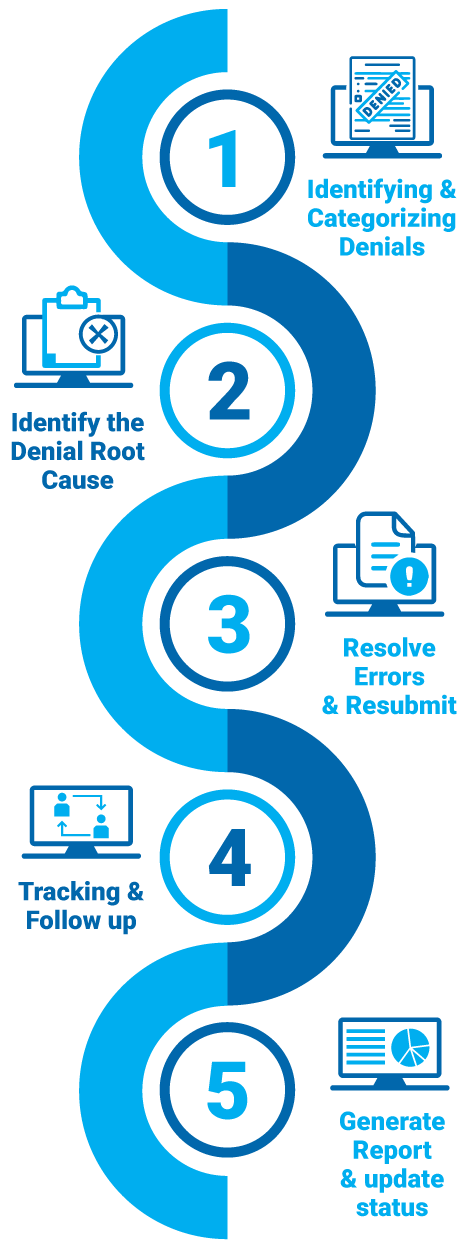

Our expert medical billing denial management services at Star Billing Solutions follow a strategic workflow approach to improve claim approval and optimize revenue. From now on, clinics, hospitals, and laboratories where healthcare practitioners can focus more on patients' health and collect every dollar they deserve.

Identifying denial claims.

Categorizing denials based on type.

Analyze the denial root cause.

Appeal and re-submitting the claim timely.

Denial tracking and follow-up.

Escalation of a denied claim.

Generate report and update status to the provider.

Contact our professional healthcare denials management team to maximize reclaim recovery in a three-step interaction process.

Reach out to our medical claims denial management services and hand over your denial claims insights. After analysis, our expert denial management team will finalize an agreement outlining the service details.

Now, we’ll schedule your meeting with our denial management experts, where you’ll discuss the causes of denials. In return, our experts will outline a resolution approach and explain a process aligning with practice's needs.

In this phase, a certified insurance claim denial expert will audit your claim denials, supporting documentation, and payer details. Based on these findings, a customized and detailed strategy will be ready for appeal and resubmissions.

Our experienced experts track the claim response from payers and get back to healthcare providers with comprehensive claim recovery reports, insights into denial trends, and best practices for minimizing future issues.

Customize Your Star Billing Solutions Experience Now!

Our trusted expertise in medical denial management offers reliable support and personalized denial management solutions in 30+ specialties.

Family Medicine

Family Medicine Physical Therapy

Physical Therapy Mental Health / Behavioral Health

Mental Health / Behavioral Health Laboratory Billing

Laboratory Billing Chiropractic Care

Chiropractic Care Telemedicine

Telemedicine Pain Management

Pain Management Dermatology

DermatologyI have been working with this coding denial management services for 2 years and during this time, there has been a dramatic drop in claim denials. These professionals not only identify errors but also resubmit claims timely, which never get rejected again. Now I am more focused on patients rather than paperwork.

Denials and appeals management was one of the biggest challenges in our revenue cycle management. Star Billing Solution has helped us streamline our process with real-time tracing and denial prevention strategies. They not only fix denials but also prevent them from happening in the future. Working with them helped us improve reimbursements and RCM.

My physical therapy clinic struggled a lot with complex claim denials until I approached Star Billing Solution’s best denials management specialist. These partners reduce claim denials and ensure compliance with changing industry regulations. Their analysis of claim denials and quick resolution have saved us both time and money. Highly recommend it for any therapy practice.

As an industry-leading denial management specialist, we strive to offer a 50% to 70% denial recovery rate. This results in faster reimbursement, fewer claim denials, and an improved revenue cycle.

There are two prominent types of denial, which include soft and hard denials. Soft denials caused by missing or inaccurate codes and patient detail errors, which may resolve within a few days to weeks. Hard denials caused by non-covered services or missing timely filing deadlines, which may not be reversed, resulting in lost revenue.

Claim denials are categorized into three subparts.

Administrative denials: Caused by claims denial management including missing patient information, incorrect documentation, etc.

Clinic Denials: It occurs when a medical necessity or appropriateness of a procedure is questioned by the payer.

Policy Denials: Issues raised by insurance claim coverage guidelines which include non-covered services, out-of-network providers, etc.

Outsourcing denial management services helps healthcare providers to stay updated to the industry changes and make sure every claim meets payer and regulatory guidelines.

Different error types could lead to claim denials, including incorrect billing information, duplicate claim submissions, missing or incorrect modifiers, and missed deadlines.

By outsourcing denial management services, providers freed up their teams from managing complex denials. As a result, they spent more time examining the patient's care, which positively impacts the patient care.

Every denied claim is a revenue loss. So let us fight for your payments while you focus on patient care.

Get an instant recovery on your lost revenue