Sometimes patients avoid being a part of the insurance claim process. Hence, they allow the provider to obtain reimbursement directly from the payer through an AOB form.

Now, what does AOB mean? It simply stands for assignment of benefits, a contract between the patient and the provider that allows the provider to reimburse the service cost directly from the payer.

Need a more detailed overview? This guide explains everything, including what is assignment of benefits purpose in medical billing, how it works, and lastly, a PDF form for more real insight into it.

The assignment of benefits medical definition states that an AOB is an agreement that allows the provider to receive reimbursement payment directly from the insurance company. When patients sign this form, they ultimately allow their payer to pay the provider directly.

This bypasses the need for the patient to pay upfront and then wait for reimbursement. In short, the medicare assignment of benefits process simplifies the billing for both the patient and provider. It ensures providers are paid promptly and patients do not have to deal with insurance claims.

An assignment of benefits form is responsible for designating who is responsible for paying any future medical bills that arise after the procedure. It serves multiple purposes for both patients and providers, such as legally granting the provider the right to request payment from the payer.

This means a provider has a stronger legal standing in case of non-payment or can directly appeal insurance denials. Additionally, it makes the payment transparency factor clearer for patients. Assignment of insurance benefits does this by allowing patients to understand what services will be billed and who will get reimbursement, ultimately limiting the surprise billing for patients.

Assignment of benefits is used in various healthcare services where third-party payers Medicare, Medicaid, private insurer) are involved. This form is most widely used in.

Patients signing the assignment of benefits authorizes these service providers to communicate directly with the insurer, enabling faster payment. However, providers with out of network insurance do not comply with any payer, so they cannot obtain an AOB form.

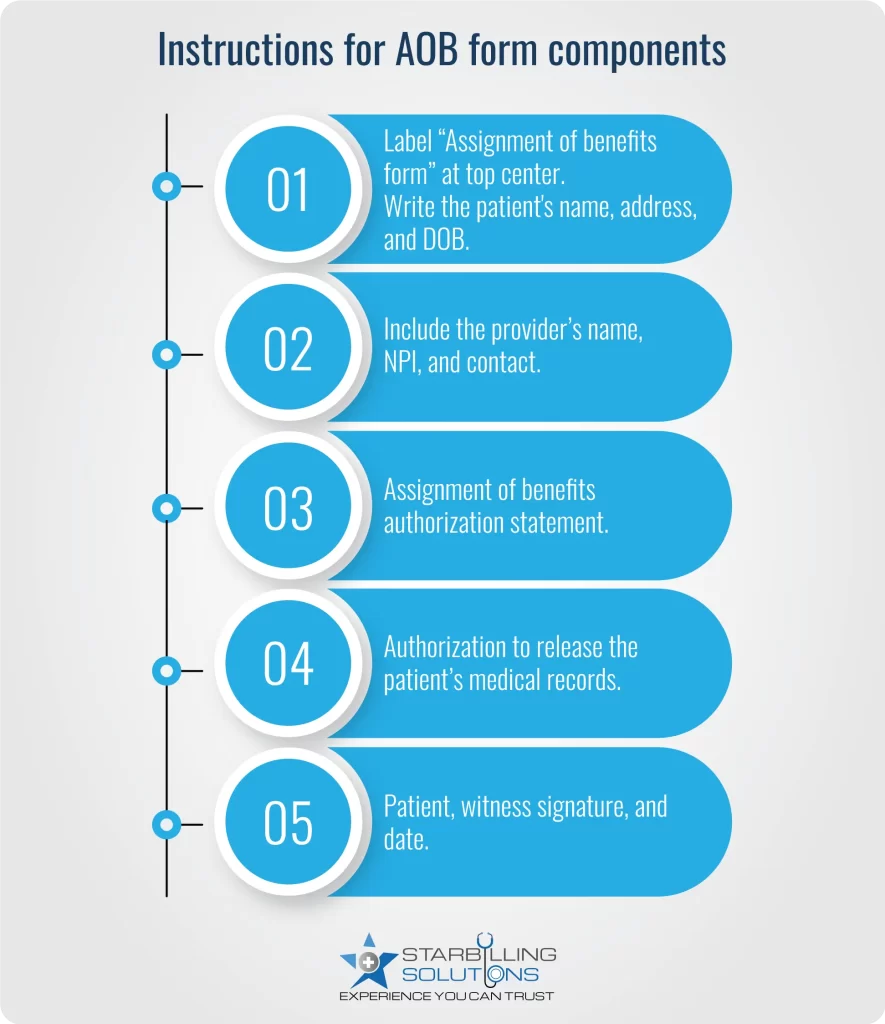

An assignment of insurance benefits form in medical billing consists of patient and insurance info, a statement of authorization, a signature, date, etc. Here’s how to include this information in the form to ensure legal protection, proper communication, and faster reimbursement:

The first section of the assignment of benefits insurance form lists valid patient information, such as the full legal name, DOB, Phone number, and email address. This record is necessary for the payer to identify who is assigning the benefit form and assist them in reaching out if necessary in an emergency.

Insurance information is for the providers’ own use. They include it because it enables them to bill the correct insurer directly and also ensures the claim is submitted by considering the policy details. Common information about an insurance company covers details like the insurance company’s name, the policy number, and the plan ID.

This is the major section under an assignment of benefits in medical billing, where a provider writes off a statement of authorization. This statement officially announces that the patient is handing over the claim permission to the provider, and it will apply to any health insurance benefits, accident or auto coverage, or other applicable insurance plans. Without adding this section, a provider legally cannot collect payment directly from the payer.

Under this clause, the insurance assignment of benefits authorizes the providers to share necessary documents with the insurance company. These include treatment records, diagnosis codes, progress notes, or medical justification. Providers share these documents along with the claim because most Insurance companies ask for them as evidence of real treatment progress.

This clause is important because it ensures the patient has read and agreed to the terms of the AOB. The form is invalid without a real signature, leading to claim denial. Further supporting information includes the date when the AOB is signed and the name of the guardian or witness.

Attaching provider information in the AOB is optional but highly recommended. It makes the form look more professional. Payers accept assignment of benefits form easily when they navigate to the provider to whom the claims need to be reimbursed.

Let’s consider an assignment of benefits example to learn how it works for both the patient and the provider.

Michael needs surgery, which costs 15000$. Before the procedure, doctors ask him to sign an assignment of benefits insurance form. Signing this form authorizes the providers to collect payment directly from the insurer without involving Michael.

Once the surgery is accomplished, the claims with a signed assignment of benefits are paid to the payer directly through the in-house billing team. Instead of sending the $15,000 to John, the insurance company pays the hospital directly based on his coverage. Let’s say Michael’s Payer is responsible for covering 80% of the total cost, which makes the $12000, and the remaining $3,000 (this could include his deductible, copay, or coinsurance) will be paid by Michael’s itself.

Download Assignment of Benefits Form PDF

When a patient signs the insurance assignment of benefits form, the billing process becomes slightly different from usual. Therefore, we present the steps showing how assignment of benefits works in medical billing.

1) Patient Gets Treatment: The patient visits the clinic or hospital and receives the necessary treatment, procedure, tests, or therapy.

2) Patient Signs the AOB Form: The provider asks the patient to sign the medicare assignment of benefits form before, during, or after the procedure.

3) Provider Sends the Bill: After the treatment procedure, the provider delivers a claim to the insurance company using the necessary visit details and referencing the signed AOB.

4) Insurance Pays the Provider: The payers process the claim and send payment directly to the provider, covering the eligible portion of the service.

5) Patient Pays the Leftover Amount: The patient will pay the remaining balance, such as deductibles and copays, that are not covered by insurance.

Assignment of insurance benefits (AOB) presents a few challenges that patients and in-network providers must combat for a flawless billing process.

Even after the patient signs the assignment of benefits insurance, the insurance company still denies the claim. This could be due to the patient not being registered with the potential payer, the service or treatment the patient receives not being covered under their insurance plan, or even coding and billing errors from the provider’s end. These denials may result in providers not receiving their reimbursement for hospitals.

Assignment of benefits in medical billing comes with a challenge of fraud and misuse by unprofessional providers. Some unethical providers plan to use the AOB form for services the patient didn’t receive, or even sometimes by billing an excessive treatment amount. Submitting such fraudulent claims could ruin the practice’s image and lead providers to pay hefty fines upon being caught.

Due to fraudulent acts discussed above, some payers didn’t receive the medicare assignment of benefits form. Therefore, it’s better to check any insurer’s legal and compliance standards regarding AOB. If they don’t deal with AOB, you’d better avoid providing it to the patient.

Despite challenges and issues, an expert medical billing agency assists you in making the assignment of benefits much easier for providers. With quality assistance, expert billers take on key responsibilities and improve the revenue cycle.

Expert billing service verifies that the medicare assignment of benefits form is signed with valid information, such as patient, provider information, and authorization statement. Additionally, the claims are accurately coded with CPT, ICD-10 codes, and modifiers. When claims are clean and accurate, the billing service ensures you get reimbursed without any denial.

Assignment of benefits is necessary to meet payer and state regulations. The expert billing teams are well-grounded in HIPAA compliance and securely store and maintain the AOBs for audits or insurer requests. With this expertise, they prevent you from penalties and legal matters for healthcare providers and make payment processes easier.

Instead of spending hours verifying AOB forms, documenting claims, submitting, tracking, and appealing, providers can now focus on patient care. While these billing duties are the billing service’s responsibility to ensure a smooth AOB-linked reimbursement process.

Denial management services are the solution even when an insurance company denies a claim with a valid Medicare assignment of benefits. These experts analyze denial reasons, resubmit correct claims, and provide supporting documentation. Professional assistance for management and dispute matters a lot because they fight for reimbursement based on AOB legal terms.