An ABN in medical billing lets patients know whether or not the payer covers a service. Understanding the advance beneficiary notice form avoids denied claims and maintains Medicare compliance.

Millions of patients, enrolling in the Medicare program, seek services from providers around the US. But not all services are reasonable and necessary for patients, which is why the medicare program often rejects those services for reimbursement. That’s when providers are required to issue an advance beneficiary notice (ABN) to the patient.

An Advance Beneficiary Notice, sometimes called an Advance Beneficiary Notice of Noncoverage (ABN), is issued by medical providers to beneficiaries of Medicare. By transferring this form to Medicare beneficiaries, providers can ensure that Medicare will not pay for the service or item. The CMS issued this standardized form (CMS-R-131). The advance beneficiary notice medicare notifies patients in advance that:

ABNs help providers prevent revenue losses by transferring the financial liability to patients if Medicare denies a bill.

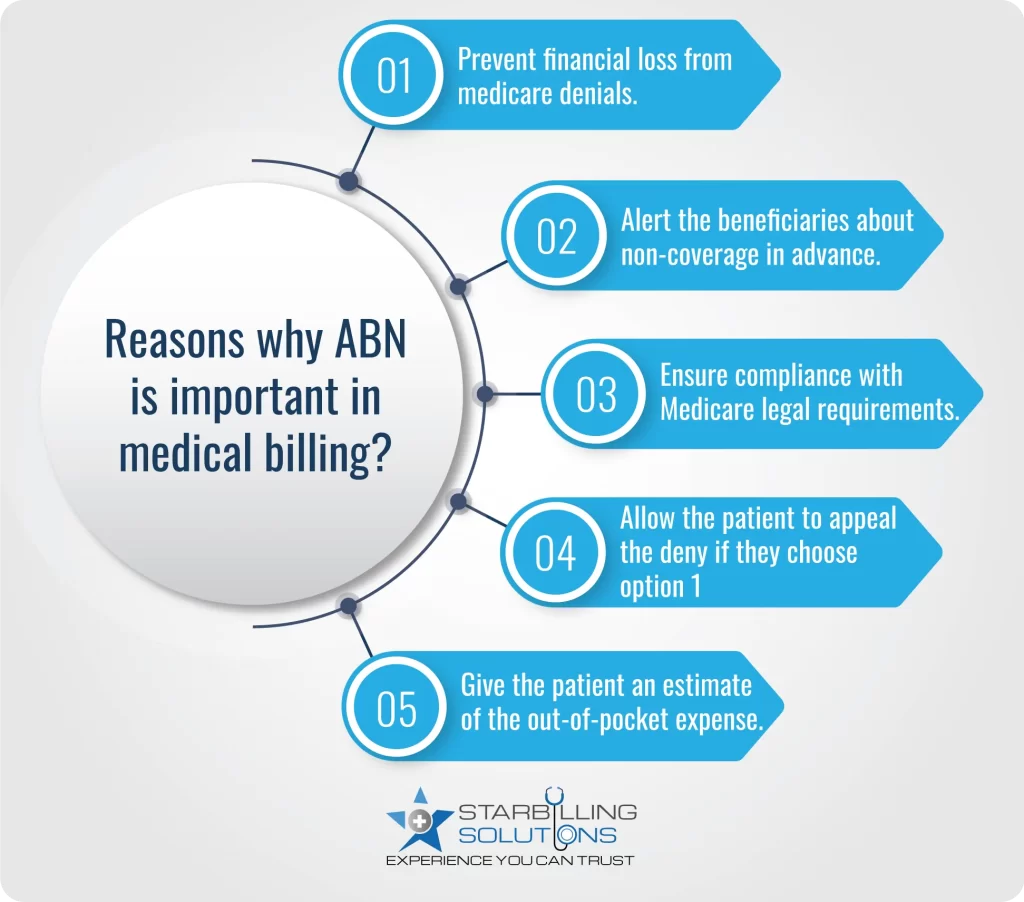

An advance beneficiary notice form is important for both patients and providers in terms of financial loss, compliance, and miscommunication. Let’s elaborate on how ABN is important for both entities.

Advance beneficiary notice Medicare assists providers in complying with CMS guidelines. When Medicare is more likely to deny the payment for the service, the provider issues this form in advance to the patient, so they can be informed that they may have to pay out of pocket. This is a legal requirement under Medicare rules, which protects the providers from future audits and potential penalties.

Providers protect their finances when patients sign the advance beneficiary notice of noncoverage. It means whenever Medicare denies the provider’s claims, the financial liability moves to the patient, so the providers are not facing any health care reimbursement problem.

The ABN in medical billing delivers transparency to the patient in advance by helping them understand which services may not be covered by Medicare and why. This prevents the patient from surprise billing and allows them to make informed decisions regarding the service rendering.

Issue an advance beneficiary notice of non-coverage to the patient when you suspect Medicare may not cover the service due to:

In short, an ABN should be given before the service or item is delivered to the patient, so there is no misguidance about payment, and providers could maintain their healthcare revenue cycle.

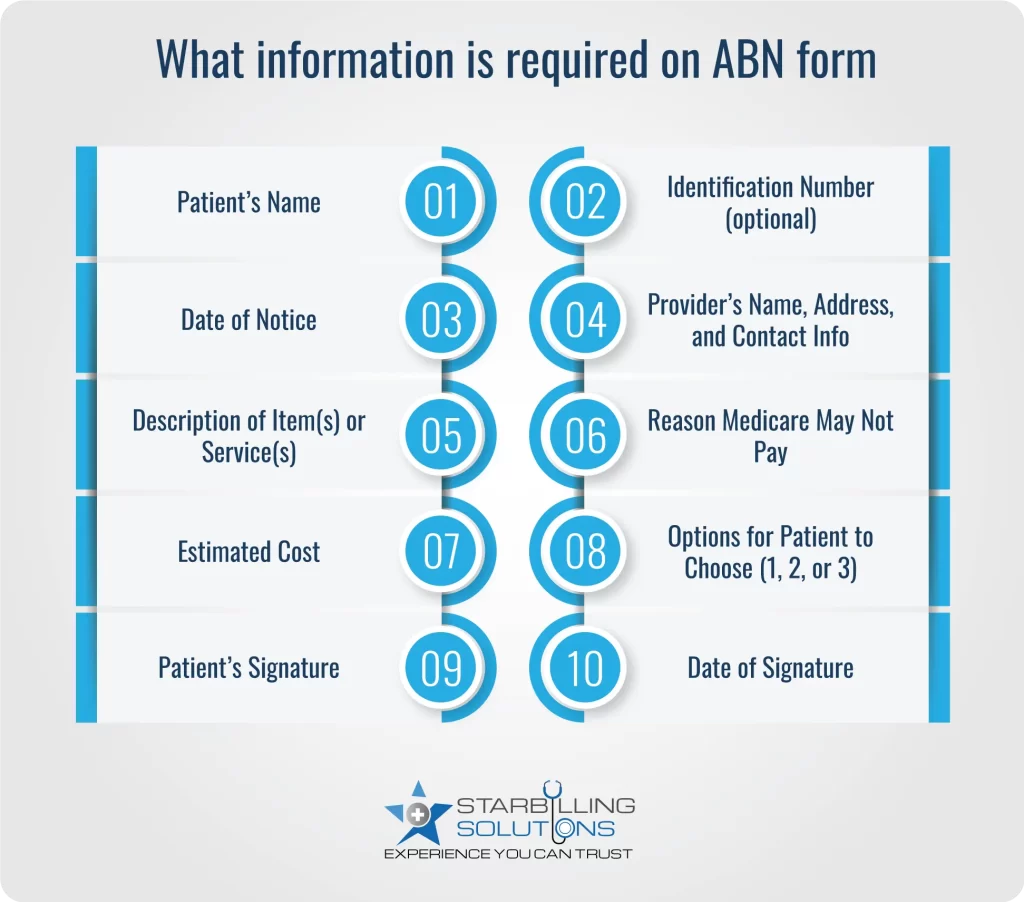

The ABN form in medical billing must be filled out accurately and should be presented right before the service is rendered. Here are the core elements to include in ABN:

A) Notifier (provider): Your name, address, Telephone no.

B) Patient’s name.

C) Internal ID (Optional)

D) The non-covered service (e.g, Anesthesia)

E) Specific service or item and estimated cost.

F) Valid reason why Medicare may deny the claim:

G) Estimated Patient cost, which will be within 100$ or 25% of the actual cost.

H) Patient options:

I) A signature box where the beneficiary or their representative will sign and put the date.

The advance beneficiary notice medicare is divided into two subtypes, which include mandatory and voluntary ABNs. Here’s what to expect using both types.

Mandatory ABN in medical billing is used in a situation when providers know Medicare is expected to deny the payment for the item or service under section 1862(a)(1) of the Social Security Act. This form is required when services are:

Voluntary ABN form in medical billing informs the patient about potential costs and empowers them to decide on their care. This form is issued when:

Download ABN for Non-Coverage PDF

Providers use the ABN modifier on claims to validate and inform Medicare and beneficiaries about noncoverage and patients’ responsibilities for payment. The correct use of ABN ensures the claims are processed correctly. Here’s how to use ABN-related modifiers.

| Modifier | Meaning | Role |

| GA | Mandatory ABN issues | Used when you expect denial due to medical necessity, and the beneficiary is aware of their financial responsibility if denied. |

| GX | Voluntary ABN issues | Use for services excluded by Medicare, but the provider is still providing them. |

| GY | Statutorily excluded service | Used when a service is excluded from Medicare and the patient wasn’t notified. |

| GZ | No ABN issue | Use if you failed to provide an ABN (claim will be denied with no patient liability) |

Always remember to avoid using GZ unless it’s necessary. The reason is that it implies non-compliance and results in zero reimbursement.

A Medical beneficiary can appeal to advance beneficiary notice of noncoverage only if they choose to receive service and select option 1 on the ABN form. This field represents that the provider is allowed to bill the service to Medicare.

Once the bill is denied, Medicare provides the beneficiary with a Medicare Summary Notice (MSN), which states the reason for the denial.

To appeal the MSN, the beneficiary got 120 days in which they had to respond according to the instructions.

However, this appeal should list the reasons why they believe Medicare should pay for the service, along with supporting documents such as the Medical record, advance beneficiary notice form, and denial.

The appeal is sent to the Medicare contractor listed on the MSN.

Lastly, the patient would have to maintain all related paperwork, including the signed ABN, throughout the appeal process.

An advance beneficiary notice form checklist is mandatory for providers to ensure the form is fulfilling compliance with CMS. Key guidelines to focus on while compiling an ABN are as follows.

Using the advance beneficiary notice of noncoverage is the best way to maintain transparent medical billing and effective patient care. It involves issuing the form to the patient, getting it signed, and then proceeding to the claim. However, with a third-party expert biller, this entire process becomes smooth and flawless.

At Star Billing Solutions, we take the responsibility of advance beneficiary notice management and medicare compliance. With our expert team, we ensure your every ABN is handled accurately. So, whether you need help with staff training, compliant documentation, or a complete billing report, we are here to take care of your RCM from start to finish.

Healthcare providers should eliminate the following errors when issuing ABNs to beneficiaries.

ABN forms are only allowed to be issues when the medicare service is not reasonable or not necessary to cover under insurance.

An ABN form is valid for 3 years as per the rules. The most recent expired ABN form date is 6/30/23, and the next form will expire on 1/31/26. If you are using a form that has written 6/30/23 at the bottom left corner, it means the form is invalid.

Whenever a provider forgets to issue an ABN to a patient and Medicare denies the claim, the provider has to absorb the entire cost, not the patient.

Yes, the electronically delivery of ABN is permitted, but providers must still provide a hard copy if requested by the beneficiary. However, the patient has to fill out the form accurately and deliver the signs.

If any patient refuses to sign the properly issued advance beneficiary notice, Medicare will not deliver the service or item. Except in emergencies, when a patient cannot sign the form. In such a condition, the health of the patient would be the highest priority.