As a healthcare provider, whenever you receive a Medicare claim reimbursement, there is always a 2% deduction on the total bill. This is called the medicare sequestration, which the government imposes to cut down the federal spending across various sectors, including healthcare.

This 2% sequestration Medicare is charged without your permission, due to which many providers want to know how to handle it. However, you don’t have to worry now because in this guide, you’ll learn about sequestration in medical billing, its impacts on healthcare, and how to reduce it in effective ways.

Sequestration in medical billing also refers to a mandatory sequestration – reduction in federal payment, responsible for affecting Medicare payments to healthcare providers. This term first originated under the 2011 Budget Control Act. As a result of the Act, automatic, across-the-board spending cuts were enacted to reduce the rising national deficit, generally known as sequestration.

Overall, sequestration reduction in medical billing specifically applies to Medicare Fee-for-Service (FFS) payments, starting from April 1, 2013. This 2% reduction is not charged from the patient’s out-of-pocket cost, but this cut is applicable only to the payment that Medicare paid to the provider for the rendered service.

Medicare sequestration was introduced in medical billing to control federal funding. This was enacted by the Budget Control Act of 2011, when Congress failed to agree on a deficit reduction plan. As a result of this act in 2013, Medicare faced a $9.9 billion cut in its first year of sequestration in medical billing. Every year, billions of cuts are collected through sequestration, which are aimed at reducing the national deficit.

The sequestration adjustment is applied to Medicare FFS Part A, B, C, and D claims. Even the prior authorization approved medicare claims are subject to sequestration reduction. However, some Part D low-income subsidies, Part D catastrophic subsidies, and qualified Individual premiums in Medicare are specifically exempt from sequestration. Additionally, the Medicaid program, patients’ deductibles, and coinsurance payments are also excluded from the sequestration amount because it applies on payment only that Medicare pays to the provider.

To learn how to calculate sequestration amount in medical billing, start by knowing what sequestration is.

Medicare sequestration reduces the insurance reimbursement cost by 2% due to federal budgeting constraints. For example, a provider bills Medicare for a procedure costing 1000$. Now, let’s say Medicare allows 80% for the reimbursement, and the patient is responsible for the remaining 20%.

The sequestration in medical billing only applied to insurance payments, and the patient is still responsible for paying the full 200$. The sequestration does not affect the patient portion.

Currently 2% medicare sequestration reduction is applied. However, the American Hospital Association (AHA) is actively persuading Congress to provide further relief from sequestration cuts or eliminate them entirely. Sequestration updates over the past few years and predictions for the future are listed below.

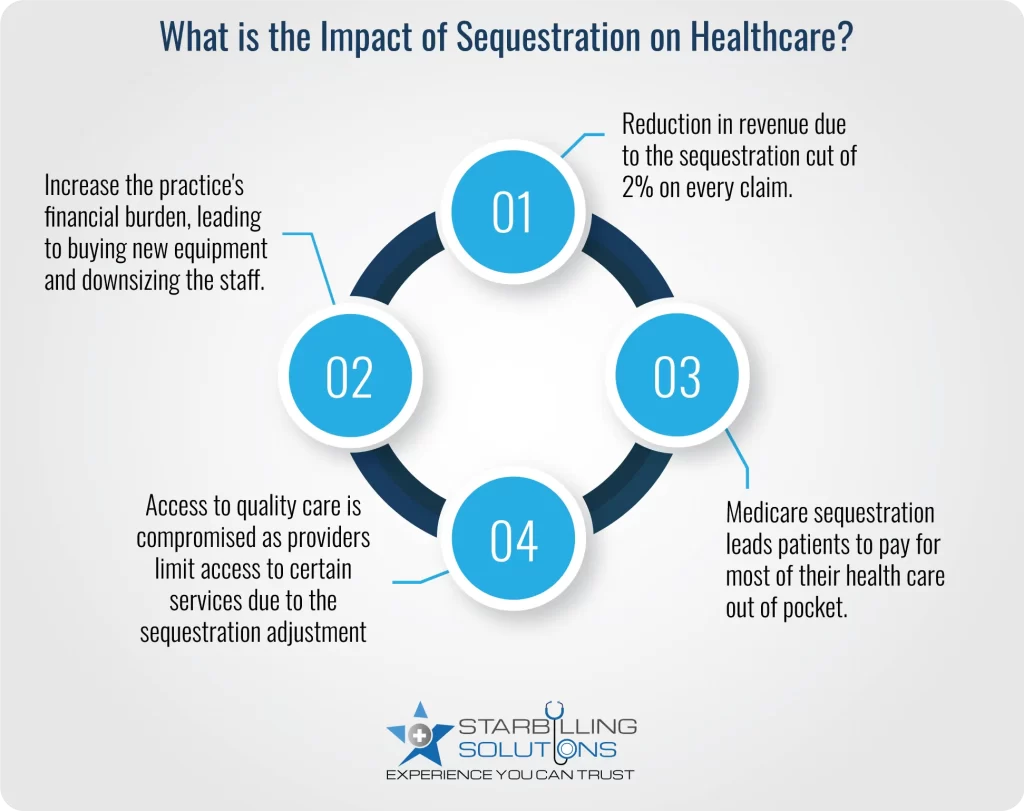

Sequestration reduction in medical billing impacts practices through financial strain, revenue loss, and an increase in patient responsibilities. For a more detailed explanation, read below and learn how Medicare sequestration impacts the healthcare business.

Practices, especially the small ones and others operating in rural areas, face a reduction in revenue. Likewise, in 2023, MGMA states that group practices experienced up to 8.5% cuts due to a combination of sequestration and other rate reductions.

The reduced reimbursement due to the 2% sequestration amount increases practices’ financial burden, such as purchasing new equipment and paying utility bills, rents, and the need to downsize their staff.

Sequestration cut is not directly applied to patients’ part of payment, but providers may shift sequestration cost indirectly through exceeding the service cost. This will potentially higher the out-of-pocket cost, which will impact the patient’s financial situation.

A survey by AJMC states that at the beginning of 2016, each practice typically faced a 28% to 31% loss due to the sequestration medicare adjustment. This financial strain causes the providers to limit the facility’s equipment or availability to certain services, leading patients to wait longer for treatments and appointments.

To minimize the impacts of sequestration in medical billing, make sure to properly document every claim, monitor the fee schedule actively, and ensure that revenue streams are diversified. For deeper insight, we have elaborated the key tips below.

Accurately document and review all the services and codings on claims for faster reimbursement with fewer denials.

Make sure your CPT, HCPCS, and ICT codes are accurate and up-to-date for best billing practice.

As a practitioner, you should regularly update and monitor the service charges to mitigate the risk of revenue losses resulting from sequestration reduction in federal payments.

Apart from Medicare, try to push your practice to offer commercial plans and direct-pay services. This way, your practices will be more likely to reduce reliance on Medicare, which leads to sequestration.

When you make sure you streamline your practice’s workflow and operational processes, it means you reduce overhead costs, enabling you to maintain your business’s profitability despite the sequestration medicare reduction.

Openly talk with patients about their responsibilities for payment changes and billing issues due to sequestration. Taking this step will help you to ensure they aren’t caught off guard.

Introduce a billing professional to your team who understands the sequestration adjustment and maximizes revenue retention.

Having just a 2% medicare sequestration reduction may seem like a minor cost. But collectively, it impacts the practice revenue on a broader level, whether operating a small, large practice or operating in a rural setting. That’s when our expert billing company could assist you in handling all adjustments, accurate claim documentation and maximizing reimbursement. With our specialized assistance, we mitigate the risk of revenue loss by adopting financial strategies and navigating the medicare sequestration adjustment. So, without wasting enough time, contact our medical billing agency near you and onboard our expert team for higher RCM practices.