When the provider is not contracted with any payer, it means they have out of network insurance. But why do patients have to figure out which providers operate as an insurance out of network? Often, after getting initial treatment, patients find out they have to pay out of pocket. This leads to surprise billing, stress, and confusion. That’s when knowing what is out of network insurance, and how to save an out of out-of-network costs is crucial.

Out of network meaning is to get healthcare treatment from a provider who is not registered with your insurance company. This means the patient has to pay the treatment cost out of their pocket.

On the other hand, the provider is responsible for offering the patient a superbill, which lists diagnosis, treatment and provider information. Additionally, in the out of network insurance, the provider sets their own prices, and based on your insurance plan, you may receive limited or no coverage for these services.

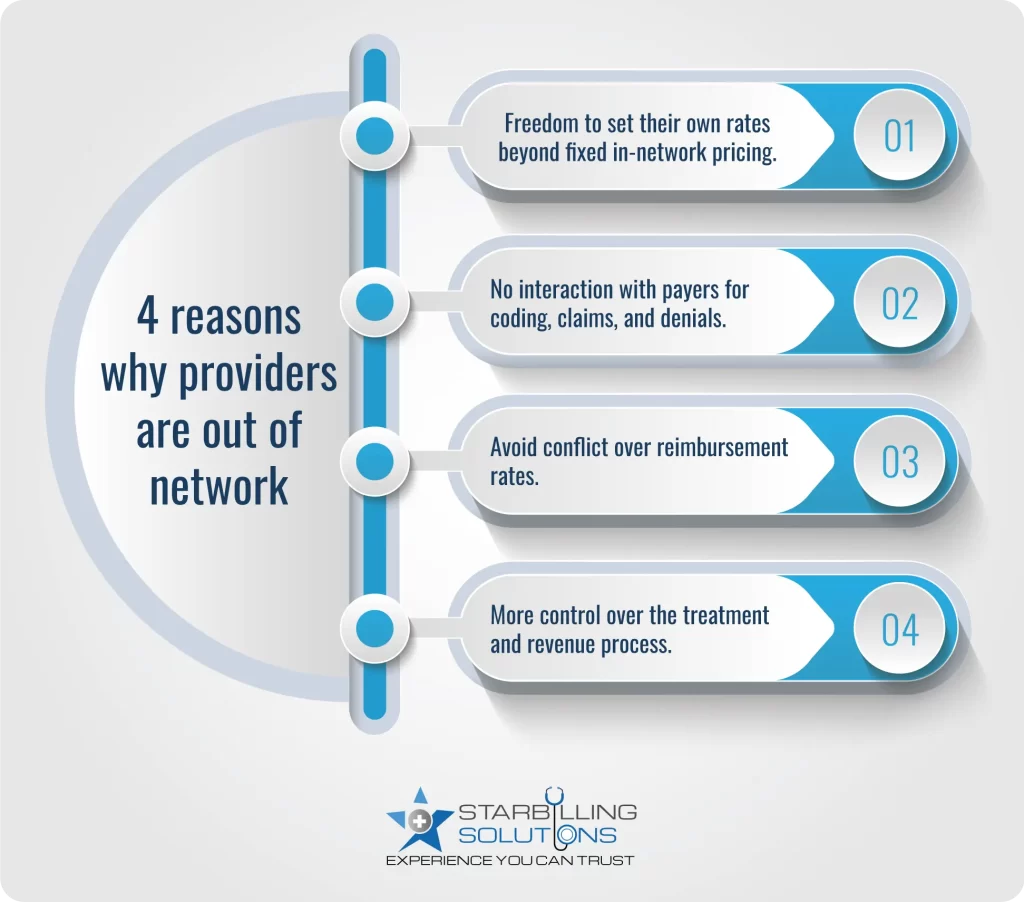

Providers operate as an out of network (OON) due to flexibility in adjusting their own rates. For example if a treatment has a negotiated price of 1000$ for in-network, they could charge 2000$ for same treatment by staying out of network. Staying out of network provider will additional assist them to stay away from burdensome administrative requirements such as medical coding, claim processing, and denials, etc.

Another possible reason could be the lack of mutual agreement on service pricing, which will help them to stay focused on treatment rather than communication. Lastly, some high-demand providers may also remain independent to get their entire focus and control over their revenue cycle and treatment processes.

Before visiting a doctor for the first time, always ensure whether it is in-network or out of network insurance. Here are 3 simple steps to verify it.

As we see different ways to identify providers, offering in network vs out of network health insurance. Now, let’s differentiate the both based on their definition, process, paperwork, financial risk, etc.

| Category | In-network | Out-of-network |

| Definition | Provider contracted with your payer. | Provider not contracted with payer. |

| Pricing agreement | Pre-negotiated rates set by the insurer. | Providers adjust their own rates |

| Coinsurance / Copay | Lower costs (e.g., 20% of the allowed amount). | Higher coinsurance or full bill, depending on the plan. |

| Billing process | Provider bills the insurance | Patient submits a claim upfront. |

| Legal protection (No Surprises Act) | Fully protected in applicable cases | Protected only in emergency or in-facility cases. |

| Paperwork involved | The provider handles the paperwork | Require patient effort for claims, receipts, and tracking |

| Financial risk | Predictable cost and no surprise billing | High risk of a surprise bill and maximum out-of-pocket cost |

| Suitable for | Routine care, preventive visit, and general treatment | Emergencies, unavailable specialists, etc. |

When you visit an out of network, you must pay the provider’s full amount, instead of a negotiated price. This means out of pocket costs get higher for you, and the provider gets the overall advantage. Additionally, your insurance expert network may reimburse a portion of that bill according to what it considers (usual, customary, and reasonable UCR).

However, if the provider fee exceeds the UCR amount the insurer agrees to pay, then you should be responsible for paying the difference. This is called balance billing, and most of the time it leads to unexpected larger medical bills.

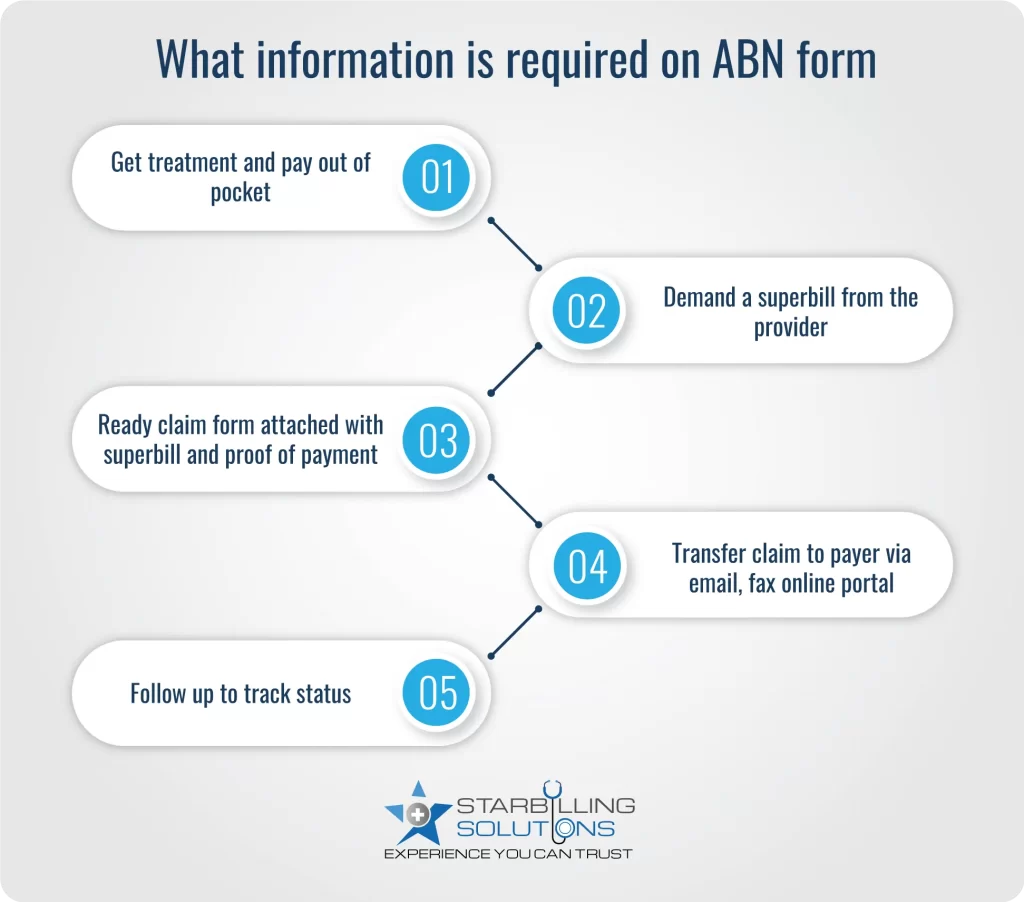

Getting out of network insurance reimbursement requires a medical superbill from the provider. The patient and expert billers then file this superbill along with a claim to the insurer to get the money spent on treatment.

Here’s an easy-to-follow process to file a claim with your insurer.

An insurance out of network care comes with a variety of cost factors that differ from in-network, usually higher in terms of out-of-pocket expense. These cost factors include:

Out-of-network deductibles are often higher than in-network ones. To prove it, let’s assume your in-network deductible is 1000$, while your out-of-network deductible might be 3000$.

In out of network insurance, you may be required to pay most of the total treatment cost. For example, you pay 20% coinsurance for in-network care, but 40% or more for out-of-network services.

Some insurance plans do not apply out-of-network costs to your annual out-of-pocket cost. This means a patient could continue paying all the larger bills without ever reaching a point where insurance covers 100% of the cost.

Negotiate the bill with the provider or ask for an estimate of the cost before getting treatment. There are further insights on how to effectively get maximum reimbursement for insurance out of network costs.

Don’t assume the bill is final. Sometimes, providers are open to negotiating the bill. Politely ask for discounts for upfront payment or financial hardship. You can also use tools like Healthcare Bluebook or Fair Health Consumer to research the fair market rate and request provider rates accordingly.

Under the No Surprises Act, providers must provide you a Good Faith Estimate (GFE) of expected treatment costs, especially if operating as out of network insurance. This estimate should list the treatment cost and related fees. Also, try to get this estimate in written form before receiving care, so you don’t get caught up with a surprise cost later.

You can still file an out of network insurance reimbursement claim even if your provider is out of network. Ask the provider to deliver a superbill, including diagnosis codes, procedure codes, and provider information. Attach this bill to the claim form and submit it to an insurance company.

Are you tired of paying an out-of-network provider out of your pocket? Get expert Medical billing service from professionals. Our experts will negotiate and submit medical bill claims with your insurer whenever you deal with an out of network insurance. With a decade of experience in billing, we can.

By hiring a billing advocate, we help you avoid paying more out of your pocket and maximize out of network insurance reimbursement from the payer. So why wait? Contact us today and let us handle your bills.

Dental insurance out of network means the dentist and facility are not contracted with your payer to negotiate at a pre-adjusted rate.

When you see a provider outside of your primary network, you will not be covered for the associated cost unless your primary plan covers out-of-network treatment. You will, however, be covered by the secondary plan's benefits if that provider is in-network.

Some high-tier insurance coverage plans, particularly Platinum and Gold, may reimburse the maximum amount, but mostly, the insurers have limits and UCR rates.

An out-of-network denial requires a written appeal, a supportive medical document, and lastly, ask providers to reaffirm and provide the superbill. Transfer all these documents to the payer for approval.