Insurance companies pay for some services only when the provider gets prior authorization. This prior authorization in medical billing is needed for higher-cost or unnecessary treatment to ensure that it is medically required and covered under insurance. In fact, this helps payers avoid paying for unneeded treatments, providers get reimbursed, and patients save out-of-pocket expenses. This article simplifies the concept of prior authorization, its importance, when it is required, how it works, and the criteria to get approved instantly.

Prior authorization in medical billing, AKA pre-authorization, is a two-way documental communication between provider and payer where doctors must get approval before delivering a service, treatment, or prescription to patients. Insurance companies use these prior authorization documents to analyze whether the service or product covered is valid.

If yes, would they be paid fully or partially? It is a necessary procedure that helps providers avoid denial lately. Overall, health insurance prior authorization ensures fast, reliable, and accurate financial support for the patient and also for providers to get reimbursed for the services they deliver.

To get prior authorization healthcare, medical experts must understand the possible medicines, treatments, and services. However, it is important to remember that emergency medical situations can be handled without this, so patients can get timely treatment without serious loss.

| Medications (need prior authorization) | Medical treatment that needs prior authorization |

| High-cost brand-name drugs | Non-emergency surgeries |

| Specialty medications (usually for chronic or rare conditions) | Advanced imaging (MRI, CT, PET scans) |

| Biological drugs (Probably for autoimmune disease) | Home health services |

| Cosmetic or lifestyle drugs. | DME insurance billing (Wheelchairs, CPAP machines, etc.) |

| Weight loss medications. | Genetic testing |

| Off-label medications. | Outpatient procedures (colonoscopy, endoscopy, etc) |

Prior authorization in medical billing ensures that a treatment or medication is necessary for a patient and would be covered under the insurance plan. That’s why prior authorization is needed. Additionally, it is an efficient way for insurance companies to avoid paying for unnecessary and expensive costs. How so? With medical prior authorization, the payers could offer an affordable solution instead of expensive treatment, which will save payers additional costs as well as save the doctor from later denial.

In another case, if a doctor is pre-authorized by the insurance company, they better know what treatment would be covered under that plan and what medications to prescribe to the patients. That way, the doctors can choose alternative, affordable medicine if the prior authorization management process supports the limited payment. Lastly, with prior health insurance eligibility verification, the practices not only raise the chance of getting approval but also make the billing process smoother and easier.

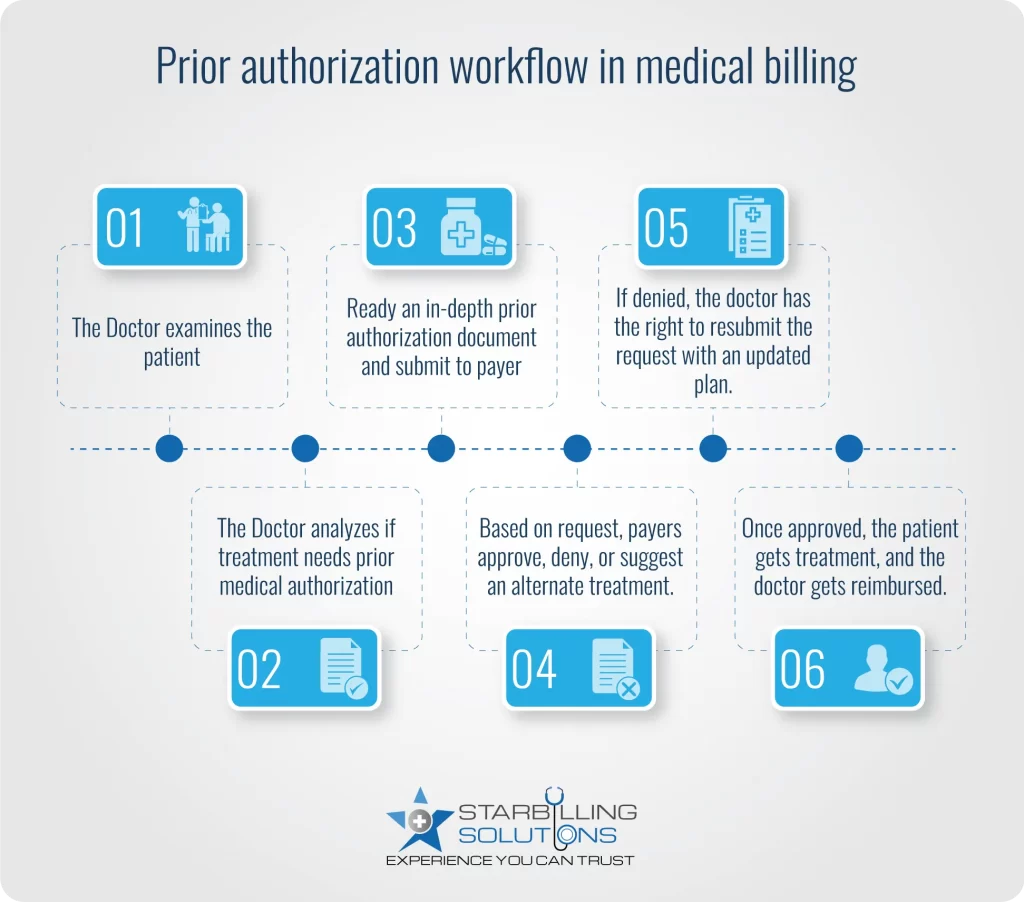

Prior authorization in medical billing, an effective process for pre-claim preparation, requires a strategic workflow to manage unnecessary or high-cost treatments. Here’s a breakdown of how it works.

However remember that the prior authorization healthcare process takes a few days to months to get response from the insurer. So, try to track follow up and make reminder calls to get a quick response.

A prior authorization request gets denied when practices lack staff, when payer regulation changes, or when there is missing information, etc. For a more detailed explanation, read below about prior authorization challenges in medical billing.

Doctors today receive more medical prior authorization cases. At the same time, there are not enough staff to handle them as the USA faces a shortage of 350,540 nurses and physicians in 2024. As a result, prior authorization insurance is not submitted correctly, leading to denial.

Insurance companies often change their rules and regulations, which makes it hard for providers to stay updated with every change. Most of these modifications are about medical service authorizations. When providers submit prior authorization in medical billing without following these new guidelines, the request may be denied.

According to the survey, 49% of physicians feel burned out and depressed at the workplace. This level of dissatisfaction results in a loss of interest while documenting prior authorization requests. Resultantly, they miss out on the patient details and code errors, leading to denials.

Only 21% of providers fully utilize electronic prior authorization management systems. This means the remaining 79% still use old-fashioned technology such as faxing, paper working, or manually calling insurance companies for pre authorization. This outdated processing leads to timely delays or even leads to excessive denials.

Insurance companies often review expensive treatment more strictly. If there is not enough medical proof to support the treatment or there is not any alternate cost-effective solution, they may deny the prior authorization request.

The results of an AMA survey are below, showing how these prior authorization healthcare challenges impact practices on a broader level.

The following tips can help practices improve their prior authorization health insurance approval rate.

To get quick approval from prior authorization in medical billing, providers need to submit all necessary information to payers related to clinics, patients, etc. This information consists of clinical notes, procedure codes (CPT/HCPCS), diagnosis codes (ICD-10), and supporting documents such as a doctor’s recommendation about service and its urgency (if the patient requires quick treatment).

Every insurance company follows its own rules and documentation for prior authorization request submission. Therefore, providers should review each payer’s guidelines repeatedly to submit a request that meets their exact prior authorization criteria. In this way, providers maximize their chances of getting approval on the first attempt.

When providers integrate the billing and pre authorization processes into EHRs, information accuracy improves, and manual data entry practices are reduced. This allows providers to save time and frustration by allowing faster request submission through the EHR.

Before proceeding with the medical prior authorization process, first check to see if the patient’s insurance plan is active and covers the service required for treatment. Also, check if the plan is restricted or limited for that treatment. This helps the provider prevent wasting time on requests that are not eligible.

If the prior authorization health insurance case is delayed or denied, a better way is to reach out directly to the supervisor, medical director, or authorization department manager. Speaking up directly to higher authorities from the payers’ side often resolves issues more quickly rather than relying on the customer care department.

At our Medical Billing Agency, we take the burden off your shoulders with our expert prior authorization management team. Whether you are a busy clinic, a small practice, or a big hospital, our expert team manages the entire process of pre authorization in medical billing. When collaborating with us, we ensure that your approvals speed up, patients get satisfied, and administrative burdens get reduced. This means your nurses and physician can now focus more on patient health while we are busy boosting your RCM.

Benefits authorization in insurance and healthcare means the insurer has approved the service and ensures that the requested services will be covered under the insurance plan.

Prior authorization health insurance could be valid from one month to one year, depending on the payer's policies and rules. Check their official documentation to ensure the validation time frame of prior authorization. However, once expires a new authorization is needed.

Prior authorization and precertification both require insurer approval. However, there is a difference: Prior authorization is a broader term covering medication, treatments, and services. On the other hand, precertification is an approval required for hospital stays or high-cost imaging tests.

According to the American Medical Association (AMA), physicians and their technical staff complete an average of 41 prior authorizations per week, which adds to their administrative workload.

Prior authorization could take 24 to 72 hours, depending on the insurance company, the complexity of the request, and whether an expedited review is needed. However, in most urgent situations (serious health issues), prior authorization can be responded to within a few hours.